Permanent impairment entitlement

This information bulletin outlines the permanent impairment provisions covered in Sections 70 to 72 of the Return to Work Act 1986 (the Act).

Payment for permanent impairment

If a worker is left with a permanent impairment as a result of a work related injury or illness there is provision under the Act for a lump sum payment in respect of that permanent impairment.

Permanent impairments are for a temporary or permanent bodily or mental abnormality or loss caused by an injury for which the insurer/self-insurer has accepted liability. For example, if a worker has an accepted claim for a knee injury following a workplace incident and later appears to have developed a secondary psychological injury due to the same incident, liability must be accepted for the psychological injury for a permanent impairment assessment to occur.

A permanent impairment assessment can only be done once the injury has reached maximum medical improvement. This is considered to occur when the worker's condition is well stabilised and is unlikely to change substantially in the next year with or without medical treatment.

Payment to the worker may be made to compensate for the permanent impairment once the injury has reached maximum medical improvement.

This payment does not affect the worker's rights to weekly compensation benefits, medical or rehabilitation expenses.

The approved guides used for all assessments are the NT WorkSafe Guidelines for the evaluation of permanent impairment. The Guidelines adopt the 'American Association Guides to the Evaluation of Permanent Impairment (5th edition)'.

No benefit is payable:

- if the assessed impairment percentage is assessed at less than five percent (5%) of the whole person

- for injuries occurring prior to 15 October 1991, if the permanent impairment percentage is assessed at less than 15%

Permanent impairment payment calculations

The entitlement is calculated using the assessed impairment percentage as a percentage of the maximum amount payable of 208 times average weekly earnings (AWE) at the time the payment is made. The AWE changes every year as published by the Australian Bureau of Statistics.

Impairments assessed at 15% and up to and including 84% of the whole person attract a benefit equal to the actual percentage given, of the maximum amount.

For example:

- If your assessed as having a 34% whole person impairment (WPI) then the amount payable is 34% of 208 times AWE.

The following example uses the AWE figures for 2023

208 x $1,710.30 (AWE) = $355,742.40

34% of $355,742.40 = $120,952.42

Amount payable = $120,952.42

Impairments assessed at 85% or more of the whole person, attract the maximum benefit.

For example:

- If your assessed as having a 87% whole person impairment (WPI) then the amount payable is 208 times AWE.

The following example uses the AWE figures for 2023

208 x $1,710.30 (AWE) = $355,742.40

Amount payable = $355,742.40

For injuries occurring prior to 15 October 1991, the entitlement is calculated using 104 times AWE.

If the assessed impairment percentage is 5% and up to and including 14% of the whole person, the amount of compensation payable is calculated on a sliding scale. This means that the percentage of the whole person that you are assessed at will translate to a lesser percentage as per the following table:

Column 1 Assessed Whole Person Percentage | Column 2 Sliding Scale Percentage – This is the % that is used to calculate your permanent impairment payment. | ||

|---|---|---|---|

5% to 9% | = | 2% | |

10% | = | 3% | |

11% | = | 4% | |

12% | = | 6% | |

13% | = | 8% | |

14% | = | 12% | |

For example:

- If your assessed impairment is 8% of the whole person then the amount payable is 2% of 208 times AWE.

The following example uses the AWE figures for 2023

208 x $1,710.30 (AWE) = $355,742.40

8% = 2%

2% of $355,712.40 = $7,114.85

Amount payable = $7,114.85

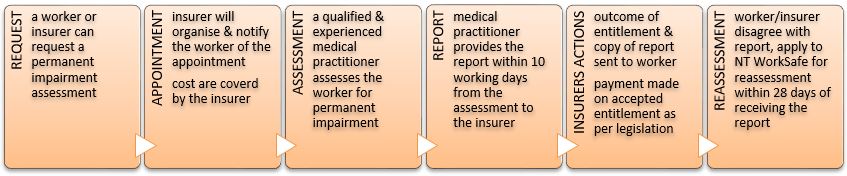

Assessment procedure

| NOTE: if a worker arranges their own assessment, the assessment report and the invoice must be provided to the employer's insurer so they can meet their legislative requirements |

|---|

If a worker believes that they have a permanent impairment, they may apply to their employer’s insurance company, or their own doctor, for an assessment of that impairment. If the worker arranges his or her own assessment, the assessment report and the invoice must be sent to the employer’s insurer.

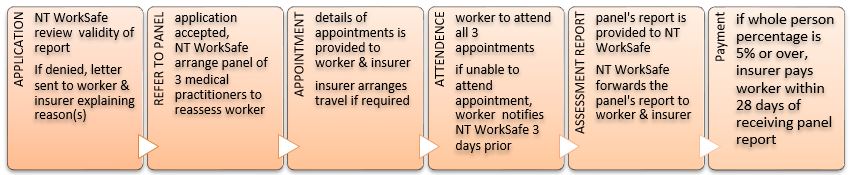

If the worker or the insurer is aggrieved by the assessment of the level of permanent impairment by a medical practitioner, the worker or the insurer may, within 28 days after being notified of the assessment, apply to NT WorkSafe for a reassessment. Such applications must be in writing.

Reassessment procedure

Upon receipt of an application for permanent impairment reassessment, NT WorkSafe will review the initial report to ensure the assessment has been conducted in accordance with the Guidelines. If satisfied with the report, NT WorkSafe will organise a panel of three doctors to carry out the reassessment. The panel of doctors will include at least one medical practitioner who, according to NT WorkSafe, has specialist knowledge of the type of impairment in question and must not include the medical practitioner who originally assessed the level of impairment.

When appointing the panel, NT WorkSafe will nominate a panel chair who is required to write a single panel report that reflects the outcome of the reassessment. All three doctors are provided with documents regarding the history of the work related injury. All three doctors assess the injured worker. The panel chair receives the notes from the other panel member's notes and determines the level of permanent impairment in accordance with the Guidelines.

The level of impairment determined by the panel is final and binding on both the worker and insurer.

The cost incurred in carrying out a permanent impairment reassessment is paid by the employer’s insurer.

Contact us

For further information please contact us on 1800 250 713, via email at datantworksafe@nt.gov.au or go to the NT WorkSafe website at www.worksafe.nt.gov.au

Permanent impairment entitlement for workers (V1.5 – 13 October 2023)

Document reviewed 15/02/2024